The ESG Advantage: Unlocking Hidden Value in Post-Merger Integration

The world of mergers and acquisitions operates on a high-stakes, unforgiving rhythm. Deal teams spend months, sometimes years, identifying targets, conducting exhaustive due diligence, and negotiating valuations down to the last decimal point. The pop of the champagne bottle at closing, however, marks not an end, but the beginning of the most perilous phase: post-merger integration (PMI). It is in the trenches of integration where the spreadsheet synergies either materialize into tangible value or evaporate into shareholder disappointment. For decades, the PMI playbook focused on combining financial systems, rationalizing operations, and merging cultures. Today, a new, powerful dimension demands a starring role in this process: Environmental, Social, and Governance (ESG) integration.

For the seasoned M&A professional, the term ESG might still conjure images of glossy corporate social responsibility reports or a compliance-driven checkbox exercise. This perspective is not only outdated; it is dangerous. Failing to embed a sophisticated ESG integration strategy into your PMI process is akin to navigating a minefield with an old map. It ignores a landscape of profound risks and overlooks veins of untapped value that can determine the long-term success of a transaction. This article moves beyond the headlines to provide a rigorous framework for understanding why ESG integration is no longer a “nice-to-have” but a fundamental lever for de-risking deals, unlocking new synergies, and building a resilient, future-proofed enterprise.

Core Concepts in a Modern M&A Context

Before diving into the strategic value of ESG, we must align on the foundational mechanics of a deal and the critical role of integration. This ensures we are all working from the same playbook.

The M&A Lifecycle: From Courtship to Cohabitation

Broadly speaking, a successful acquisition follows a disciplined process. It begins with a clear corporate strategy that identifies growth gaps or strategic needs. This leads to a rigorous target screening and selection phase. Once a promising target is identified, the acquirer initiates the due diligence process, a deep investigation into the target’s financial, operational, and legal health. This is the part where you kick the proverbial tires, check under the hood, and make sure the gleaming asset is not, in fact, a collection of problems held together by ambition.

If due diligence confirms the investment thesis, the complex dance of valuation and negotiation begins, culminating in a definitive agreement. After securing regulatory approvals and shareholder consent, the deal closes. This is the moment of legal and financial transfer of ownership. However, the economic value is only realized through the subsequent integration phase, where two distinct organizations, with their own people, processes, and technologies, must become one cohesive, efficient entity.

Why Post-Merger Integration is the Dealmaker’s Crucible

Effective integration is the bridge between a deal’s promised value and its actualized return on investment. An inefficient or poorly planned integration can actively destroy value faster than any market downturn. The challenges are immense: culture clashes can lead to an exodus of key talent, disparate IT systems can cripple operations, and misaligned customer-facing processes can alienate a hard-won client base.

The goal of integration is to capture the planned synergies—the cost savings and revenue enhancements that justified the acquisition premium in the first place. This requires a meticulously planned and ruthlessly executed 100-day plan and beyond, governed by a dedicated integration management office (IMO). The success of this phase dictates whether the new, combined company will be greater than the sum of its parts or a cautionary tale whispered in boardrooms.

Defining ESG Integration: Beyond the Acronym

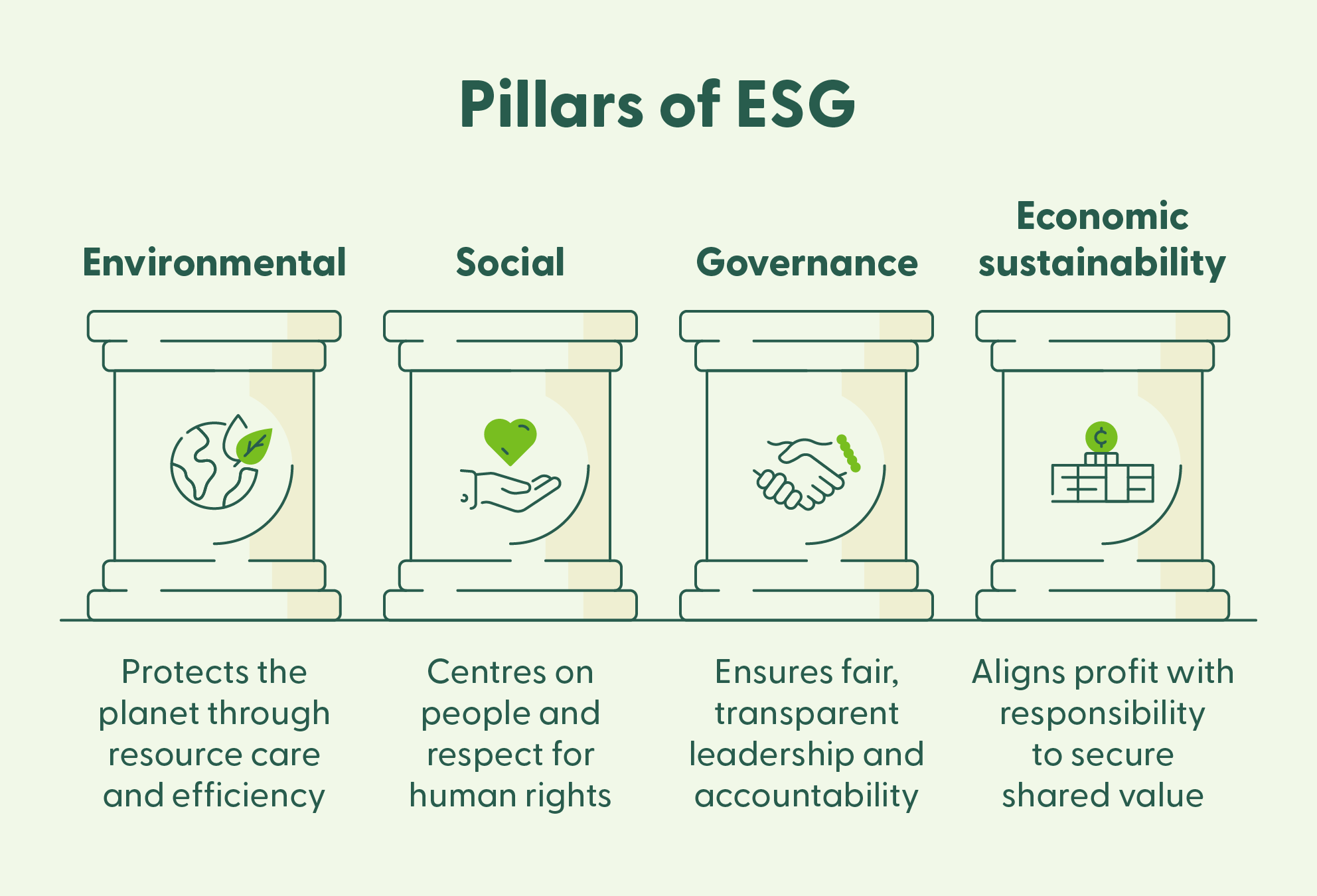

Now, let’s introduce our protagonist. ESG stands for Environmental, Social, and Governance. These three pillars provide a framework for evaluating a company’s performance on a broad range of non-financial factors:

- Environmental criteria examine a company’s impact on the natural world. This includes its carbon footprint, water usage, waste management, and exposure to climate-related physical risks like flooding or wildfires.

- Social criteria focus on how a company manages relationships with its employees, suppliers, customers, and the communities where it operates. Key issues include labor standards, data privacy, diversity and inclusion, and human rights in the supply chain.

- Governance deals with a company’s leadership, internal controls, and shareholder rights. This covers everything from executive compensation and board composition to audit committee independence and anti-corruption policies.

ESG integration in M&A is the systematic process of identifying material ESG-related risks and opportunities during due diligence and actively managing them during post-merger integration to protect and create long-term value. It is not about a separate “green” workstream; it is about embedding ESG considerations into every existing integration workstream, from operations and supply chain to human resources and communications.

Why ESG Integration Matters in M&A

Integrating ESG is not an act of corporate altruism; it is an act of financial prudence and strategic foresight. For M&A practitioners, the value proposition can be understood through three critical lenses: risk mitigation, synergy creation, and strategic positioning.

1. De-risking the Deal and Enhancing Future Resilience

Traditional due diligence is excellent at identifying past liabilities. ESG-focused diligence, in contrast, excels at identifying future ones. By integrating ESG analysis, acquirers can uncover a host of material risks that a standard quality of earnings report might miss. For instance, a target manufacturer might have pristine financial statements but operate a key facility in a region projected to face extreme water scarcity, posing a significant operational risk. Another target might rely on a supply chain with hidden labor issues that could erupt into a brand-damaging scandal.

During integration, these identified risks can be systematically addressed. The PMI process becomes the mechanism for implementing corrective action plans. This could involve:

- Upgrading Environmental Compliance: The integration of two manufacturing footprints provides a perfect opportunity to sunset older, less efficient facilities and invest in bringing all sites up to a higher, unified standard of environmental performance, reducing the risk of future fines or shutdown orders.

- Harmonizing Labor Policies: A merger is the ideal moment to assess the labor policies of both companies and establish a new, best-in-class standard for the combined entity. This proactively mitigates risks related to employee relations, union disputes, and accusations of unfair labor practices.

- Strengthening Governance and Controls: By merging two governance structures, a company can cherry-pick the strongest elements from each, creating a more robust framework for risk management, ethical conduct, and transparent reporting, which is increasingly demanded by institutional investors.

Effectively, a strong ESG integration strategy acts as an insurance policy against a growing array of non-financial risks that carry very real financial consequences.

2. Unlocking Novel Synergies and Operational Efficiencies

M&A professionals are fluent in the language of synergies. ESG integration adds new vocabulary to this language. Beyond traditional cost-cutting, it opens the door to “green synergies” and other ESG-driven value creation opportunities that can directly improve the bottom line.

The integration phase is a once-in-a-generation opportunity to redesign processes and reconfigure assets. By applying an ESG lens, dealmakers can identify significant savings:

- Energy and Resource Optimization: When combining manufacturing plants, distribution centers, and office buildings, an ESG-focused integration plan will explicitly map energy consumption and waste generation. This analysis can lead to consolidating operations in more energy-efficient facilities, investing in renewable energy sources, or implementing circular economy principles to reduce raw material costs. These are not just environmental wins; they are tangible cost synergies.

- Supply Chain Rationalization: Merging two companies means merging two supply chains. An ESG integration workstream would analyze the combined supplier base not only on cost and quality but also on resilience, ethical standards, and carbon footprint. This allows the new company to build a more efficient, resilient, and responsible supply chain, reducing both reputational risk and long-term operating costs.

- Accelerated Innovation: Often, an acquisition brings new technologies or capabilities. Integrating a target with innovative, sustainable product lines or low-carbon manufacturing processes can accelerate the acquirer’s own transition to a more sustainable business model, creating new revenue streams and enhancing competitive advantage.

These ESG-driven synergies are not theoretical. They represent concrete financial benefits that can be modeled, tracked, and reported to investors, directly contributing to the deal’s success.

3. Fortifying Brand, Talent, and Market Access

In today’s market, value is increasingly tied to intangible assets like brand reputation, human capital, and stakeholder relationships. A well-executed ESG integration strategy is a powerful tool for enhancing all three.

The message a company sends during the uncertainty of an integration is scrutinized by all stakeholders. A clear commitment to ESG principles can be a powerful stabilizing force:

- Winning the War for Talent: Top talent, particularly among millennial and Gen Z professionals, actively seeks employers with a strong and authentic commitment to social and environmental values. During a merger, when employee anxiety is high, a credible ESG integration plan signals that the new company is a forward-thinking, responsible employer. This can be a decisive factor in retaining the key people who hold the institutional knowledge and innovative capacity you just paid a premium for.

- Enhancing Brand and Customer Loyalty: Consumers and B2B customers alike are increasingly making purchasing decisions based on a company’s ESG profile. The integration period is a high-profile moment to communicate the combined entity’s strengthened commitment to sustainability and ethical practices. This can build brand equity and create a “halo effect” that deepens customer loyalty and attracts new market segments.

- Expanding Access to Capital: The global financial landscape is undergoing a seismic shift. A massive and growing pool of capital is now allocated through an ESG lens. Investment funds, lenders, and insurers are systematically integrating ESG factors into their decision-making. A combined company that can demonstrate a strong, post-merger ESG profile and clear governance through a successful integration will find itself with better access to this capital, often at a lower cost.

This third pillar demonstrates that ESG integration is not just an internal exercise; it is a strategic communication tool that shapes the new company’s identity and secures its social license to operate and grow.

ESG Integration in Action: Three Case Studies

Theory is useful, but practice is persuasive. Let’s examine three real-world examples where ESG integration principles, whether explicitly labeled or not, played a crucial role in the transaction’s outcome.

Case 1: Danone and WhiteWave Foods – A Strategic Bet on a Sustainable Future (De-risking and Positioning)

In 2017, French food giant Danone acquired WhiteWave Foods, a U.S. producer of plant-based foods and beverages like Silk soy milk and Alpro products, for $12.5 billion. On the surface, this was a straightforward acquisition to gain access to the fast-growing health food market. However, viewed through an ESG lens, the deal was a masterstroke of strategic de-risking.

Danone, with its core business in dairy products like yogurt, faced long-term risks associated with the environmental impact of dairy farming (methane emissions, water usage) and shifting consumer preferences toward plant-based alternatives. The acquisition of WhiteWave was not just a growth play; it was a strategic hedge. The integration allowed Danone to:

- Rebalance its Portfolio: By integrating WhiteWave, Danone immediately diversified its revenue streams, reducing its reliance on an animal-protein-based model and aligning its portfolio with long-term consumer and environmental trends.

- Capture a New Identity: The integration was central to Danone’s rebranding as a leader in sustainable food systems. It solidified its B Corp certification and reinforced its “One Planet. One Health” vision. This fortified its brand among ESG-conscious consumers and investors, protecting its long-term value.

The Danone-WhiteWave integration shows how an M&A transaction, guided by an ESG-centric strategy, can fundamentally de-risk a company’s business model against long-term, systemic shifts.

Case 2: The DowDuPont Merger – Finding Green Synergies in a Megadeal (Operational Efficiency)

The $130 billion “merger of equals” between Dow Chemical and DuPont in 2017, which later split into three independent companies, was one of the most complex corporate transactions in history. The primary driver was, of course, massive cost synergies, projected at $3 billion. A significant, though less publicized, portion of these synergies came from applying what can be termed ESG integration principles to their vast global operations.

The integration process required a complete rationalization of thousands of products and hundreds of manufacturing sites worldwide. This presented a unique opportunity to:

- Optimize the Manufacturing Footprint for Efficiency: The integration teams were tasked with evaluating which plants to keep, close, or sell. This analysis went beyond simple capacity utilization. It included assessments of energy efficiency, water usage, and environmental compliance records. By consolidating production in more modern, resource-efficient facilities, the new company unlocked significant operational savings that were, in essence, green synergies.

- Standardize Best Practices: Both Dow and DuPont had strong but different internal standards for environmental health and safety (EHS). The integration forced the creation of a unified, best-of-both-worlds EHS governance system for the entire organization, raising the bar on safety and environmental performance while streamlining compliance and reporting processes.

This megadeal demonstrates that even in the most financially driven transactions, ESG integration principles are a powerful tool for identifying operational efficiencies and cost savings that might otherwise be overlooked.

Case 3: Salesforce and Slack – Protecting Human and Cultural Capital (Talent and Governance)

When Salesforce acquired the communication platform Slack for $27.7 billion in 2021, it was buying more than just a software product; it was buying a vibrant ecosystem, an innovative culture, and a highly sought-after pool of engineering talent. The success of this deal depended heavily on the “S” (Social) and “G” (Governance) of ESG: retaining key people and integrating two distinct corporate cultures without destroying the magic that made Slack valuable.

Salesforce, known for its strong “Ohana” culture and its 1-1-1 model of philanthropy, had to approach this integration with immense care. A heavy-handed, top-down integration would have triggered a talent exodus and stifled Slack’s agile, developer-centric culture. The integration strategy focused on:

- Leadership and Autonomy: Slack’s CEO, Stewart Butterfield, was retained to continue leading the unit, signaling a commitment to preserving its identity and operational autonomy within the larger Salesforce organization. This governance decision was crucial for maintaining morale and continuity.

- Cultural Integration, Not Assimilation: Rather than forcing Slack employees into the Salesforce mold, the integration team focused on finding common ground in shared values like innovation and customer focus. This “Social” integration aimed to create a collaborative environment where both cultures could learn from each other, protecting the human capital asset.

The Salesforce-Slack case is a powerful reminder that in knowledge-economy M&A, the most valuable assets often walk out of the door every evening. A sophisticated ESG integration strategy, with a heavy emphasis on the “S” and “G,” is essential to ensuring those assets return the next morning.

Conclusion: The New Frontier of Value Creation

The evidence is clear and compelling. An ESG integration strategy is no longer a peripheral concern for the socially conscious but a core discipline for the financially astute M&A professional. It transforms the daunting task of post-merger integration from a simple exercise in cost-cutting into a strategic opportunity to build a more resilient, efficient, and reputable enterprise. By systematically addressing ESG factors, acquirers can better identify and neutralize future risks, uncover new and powerful synergies, and fortify the intangible assets that drive long-term growth.

As the worlds of finance and sustainability continue to converge, the ability to execute an ESG-centric integration will become a key differentiator between the dealmakers who merely transact and those who truly create lasting value. The question for practitioners is no longer if they should incorporate ESG into their PMI playbook, but how deeply they are prepared to embed it.

Looking at the landscape of your own transactions and advisory work, what is the single greatest ESG-related opportunity you believe is most consistently missed during the post-merger integration phase?

Leave a comment